-

Home Loans

Home Loans

A perfect mix of home loan options with a simple online application

-

Commercial

Commercial Loans

A perfect mix of commercial loan options with a simple online application.

- About Us

- Tools

- Blogs

- Get Started

Looking to invest in a rental property and want to know where you can get the biggest return on your investment? Recent data show which cities in New Zealand have the highest rental yields.

But first,

What is Rental Yield?

There are two types of rental yield, gross rental yield and net rental yield.

How Do You Calculate Rental Yield?

To calculate your rental yield you first need to determine the annual rent (we’ll say $40,000 for this example) and then the property value (again let’s go with $800,000)

For gross rental yield:

($40,000/$800,000) x 100 = 5%

For net rental yield:

Add up any deductions or expenses, for this example we’ll go with $8000 and take this off the annual rent.

($40,000 – $8000) / $800,000 x 100 = 4%

What is the National Gross Rental Yield?

As of August 2024 the gross rental yield nationally is 3.9%, which is the highest it has been since early 2016. If we look further back to 2010 it was between 4 -4.5% and was at its lowest in 2021 at 2.8%

How About Across Main Cities?

There are a number of reasons why a city might have a higher rental yield than others:

If you’re thinking about diversifying or expanding your investment portfolio and want your finances to be the best position then get in touch with The Finance Hub team. We’re here with you every step of the way to financial freedom. Give us a call on 0800 346 482.

Data Source: CoreLogic

Uncategorized

Uncategorized

Hands up if you too daydream of being mortgage free and what you would do with the extra money? The best way to be mortgage-free…

Auction

Christchurch

Empowers Women

Financial Literacy

Hamilton

House Purchase

Property Investment

Rental

Wellington

Auction

Christchurch

Empowers Women

Financial Literacy

Hamilton

House Purchase

Property Investment

Rental

Wellington

The Residential Tenancies Amendment Bill passed its third reading in Parliament at the end of last year and is now coming into force. But why…

Uncategorized

Uncategorized

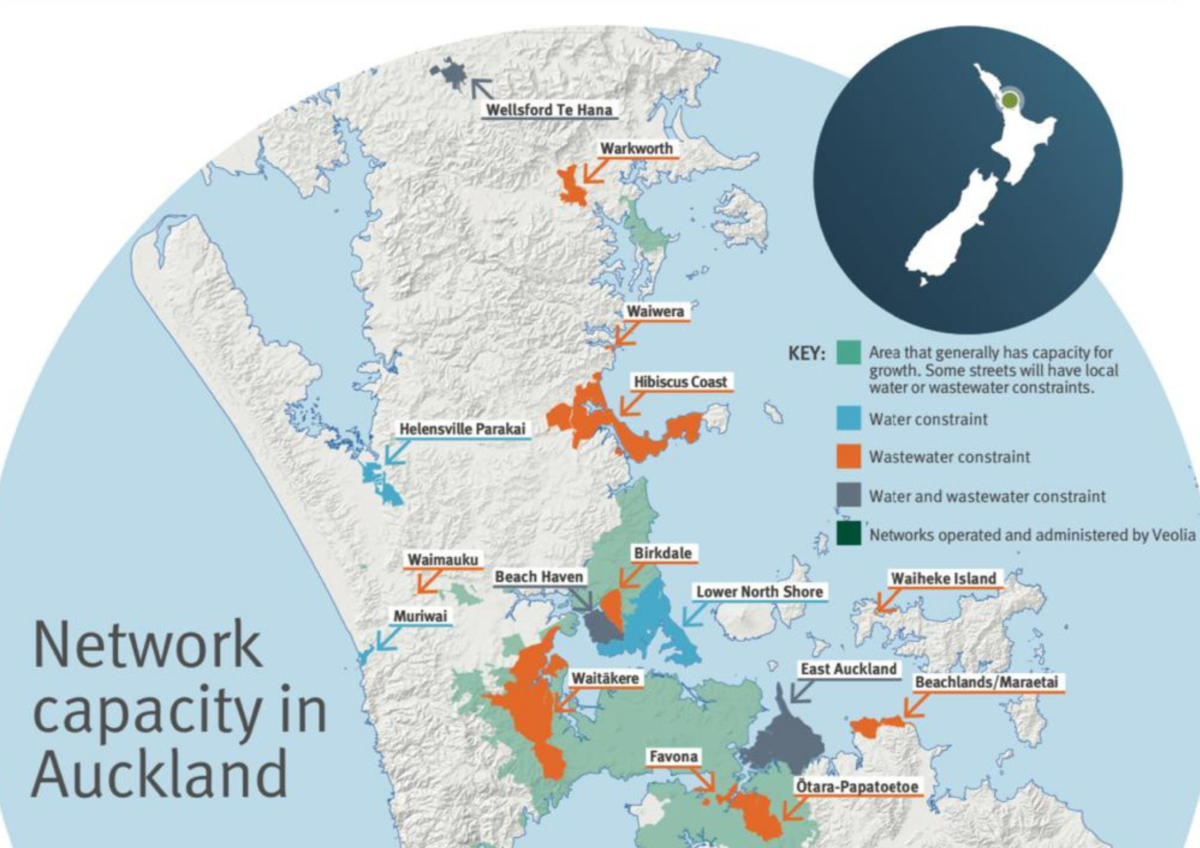

Recently parts of Auckland have been red-zoned by Watercare, Council Controlled Organisation CCO, effectively blindsiding many developers who have already bought land ready to develop.…

Subscribe and get news and information about our webpage