Prior to buying a property, it's vital to conduct a comprehensive investigation to ensure it meets your requirements. Also, verify with your lender that the property can serve as collateral for your loan, safeguarding your investment. Seeking legal counsel before entering purchase agreements is also advisable.

To start, order a LIM report from the local Council when buying a property. It provides valuable information about the property and the surrounding areas, including hazards that may impact the land.

Prospective buyers should take some additional steps before making a purchase. These steps include researching the history of flooding in the area to understand the frequency and severity of past floods. It is also essential to consult with local authorities and experts to assess potential risks and regulatory requirements. Furthermore, it is necessary to carefully review insurance options and their viability in case of any future floods. Lastly, it is crucial to consider how the potential impact of flooding may affect the property’s resale value.

Prospective buyers should ensure the property is suitable for securing any necessary lending arrangements. They should also check with their lender to ensure their satisfaction before buying.

Before purchasing a property, it is essential to conduct a thorough investigation to ensure it is suitable for your needs. Additionally, check with your lender to confirm that the property can be used as collateral for your loan. This protects your investment in the long run. It is also wise to seek legal advice before entering agreements to purchase a property.

Uncategorized

Uncategorized

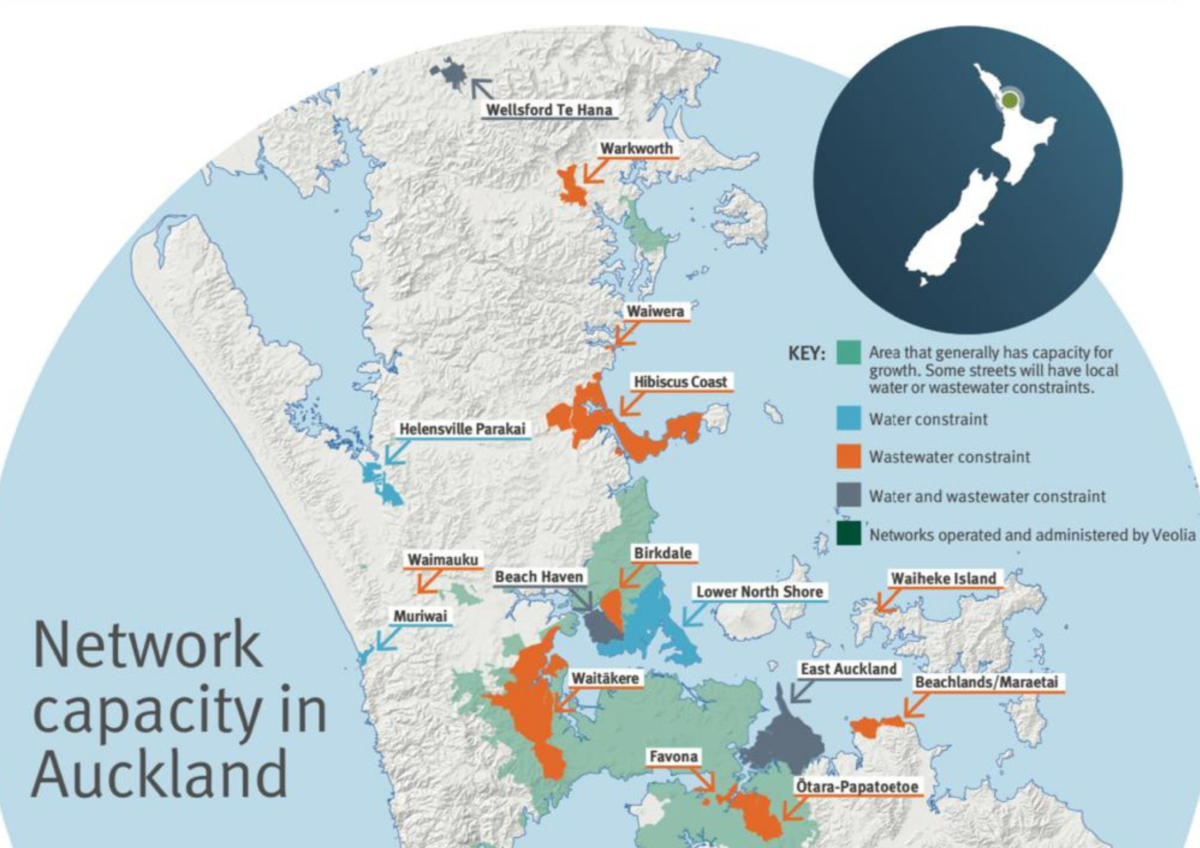

Recently parts of Auckland have been red-zoned by Watercare, Council Controlled Organisation CCO, effectively blindsiding many developers who have already bought land ready to develop.…

Uncategorized

Uncategorized

What will happen to property prices in 2025 according to the leading economists?

Auction

Financial Literacy

First Home Buyer

Hamilton

House Purchase

Interest Rate

Loan Approval

Property Investment

Property Tax

Rental

Auction

Financial Literacy

First Home Buyer

Hamilton

House Purchase

Interest Rate

Loan Approval

Property Investment

Property Tax

Rental

The fourth largest region in New Zealand, the Waikato covers over 25,000 square kilometres and includes, arguably, some of the most beautiful areas in the…

Subscribe and get news and information about our webpage