This month the Government reintroduced landlords' ability to deduct interest from their rental income, a move that the previous Labour government had been in the process of doing away with. But why were the changes made, and what could the result be?

What changes have the Government made?

In 2021 the Labour government announced they were going to phase out interest deductibility. This meant that anyone paying a mortgage on a residential investment property could no longer deduct the interest they had paid from their rental income when they were calculating their taxable profit.

However, the new coalition Government is reversing this decision and is now restoring interest deductibility for all landlords with residential rental properties (under the Labour government those investors with new build properties could still deduct interest).

Initially the rule was going to be reintroduced over three financial years as such:

– 2023/24: 60% of interest expenses could be claimed

– 2024/25: 80%

– 2025/26: 100%

Instead, from the 1st April 2024 an 80% deduction can be claimed and next year, 1st April 2025, it will be 100% of expenses. It should be noted that claims can’t be backdated for 2023/24 which had been previously discussed.

Why did they decide to reverse the decision?

Associate Finance Minister David Seymour said that the changes were made to help both “landlords and renters alike.”[1]

Landlords and property investors have been juggling both “rising mortgage interest rates and increasing interest deductibility limitations” and inevitably these increased costs have been passed to tenants. [2]

The result is that New Zealand’s housing market has been affected. Less properties are being rented out, pushing up their prices of those that are available. Not only is it more difficult for tenants to find properties to rent but it’s proving even harder for renters to be able to save for a deposit on a home.

Who will benefit from these changes?

Any taxpayer who is paying a mortgage for a residential rental property will benefit since they will be able to reduce the tax they pay on their rental income by deducting their interest expenses.

In theory if landlords are able to deduct 100% of interest from their rental income they could pass these savings onto tenants by reducing rental costs and encouraging competition in the market. Whether this happens will remain to be seen over the coming years.

N.B The views expressed in this blog are that of Falgun Patel and Roshni Patel, licenced mortgage advisors and directors of Finance Hub.

[1] https://www.beehive.govt.nz/release/government-agrees-restore-interest-deductions

[2] https://www.beehive.govt.nz/release/government-agrees-restore-interest-deductions

Uncategorized

Uncategorized

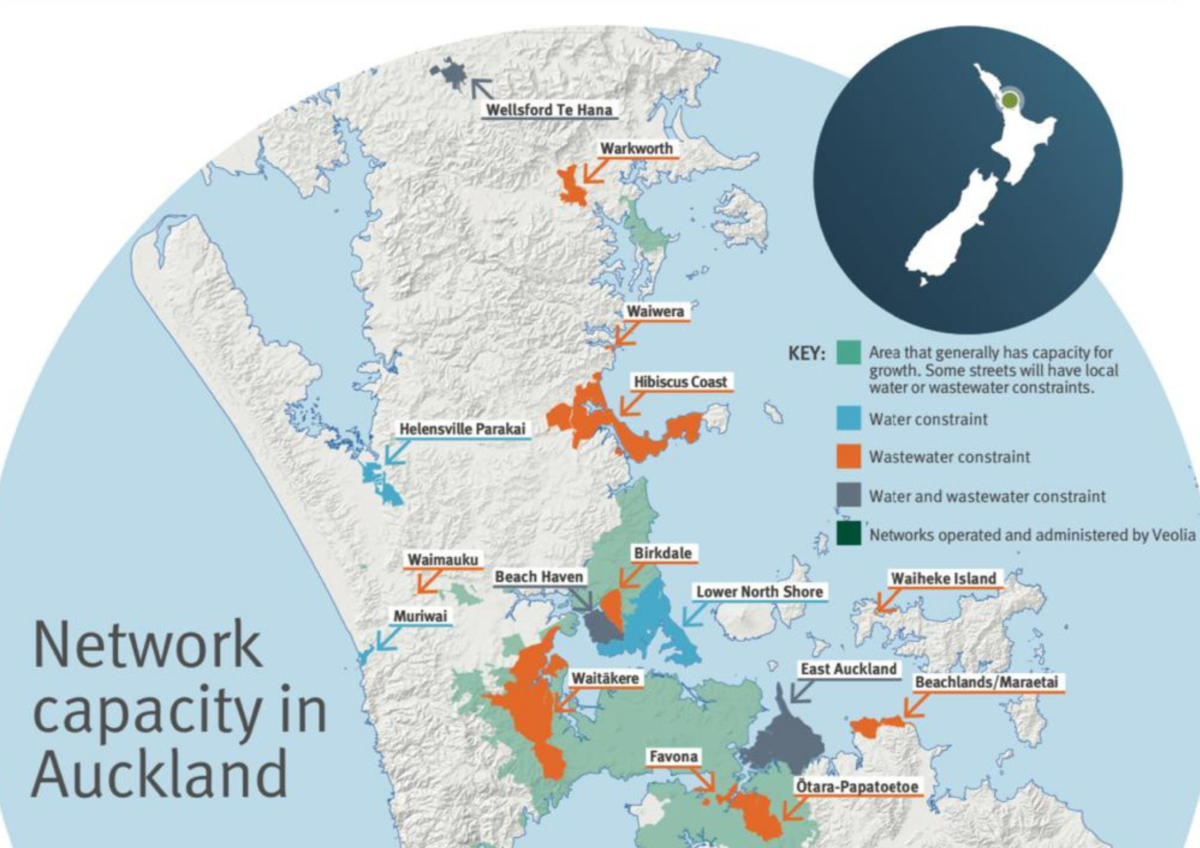

Recently parts of Auckland have been red-zoned by Watercare, Council Controlled Organisation CCO, effectively blindsiding many developers who have already bought land ready to develop.…

Uncategorized

Uncategorized

What will happen to property prices in 2025 according to the leading economists?

Auction

Financial Literacy

First Home Buyer

Hamilton

House Purchase

Interest Rate

Loan Approval

Property Investment

Property Tax

Rental

Auction

Financial Literacy

First Home Buyer

Hamilton

House Purchase

Interest Rate

Loan Approval

Property Investment

Property Tax

Rental

The fourth largest region in New Zealand, the Waikato covers over 25,000 square kilometres and includes, arguably, some of the most beautiful areas in the…

Subscribe and get news and information about our webpage