-

Home Loans

Home Loans

A perfect mix of home loan options with a simple online application

-

Commercial

Commercial Loans

A perfect mix of commercial loan options with a simple online application.

- About Us

- Tools

- Blogs

- Get Started

When you are looking to buy property it is important to understand what the property title is as this affects what you can do as an owner with the property.

There are four main property titles in New Zealand:

Freehold (also known as Fee Simple)

The most common of the property titles, a freehold property gives the owner control over the land and any buildings on it. It can still be subject to restrictions, but with a freehold property there aren’t other owners involved.

Leasehold

With a leasehold property you ‘lease’, pay ground rent to the owner for the rights to the land and any buildings on it. Your terms of lease will state how long you have these rights for. If you own a home on a leasehold property, you only own the home, not the land.

Cross Lease

Typically found on sections which have been divided up into multiple homes, a cross lease means you and the other owners each own your part of the land and lease the property from the section. For example, if a section is split into four homes, the group of four homes owns the land as a freehold and each owner is entitled to a quarter of the land and the exclusive rights to their home or building. Unlike a leasehold, with a cross lease the cost to lease your property is often minimal and the length of the lease is much longer.

Unit Title (also known as Stratum in Freehold or Leasehold)

If you live in an apartment block then it is likely you have a unit title. This means that you own your own apartment (you might also own a car parking space), but co-own any communal areas such as roof terraces, lobbies or stairwells with the other apartment owners. You do this through a body corporate which you join when purchasing the property.

It’s important to remember that with each property type there are certain key considerations to take into account. Find out what these are here.

N.B This is just a brief guide, for more information please get in touch with our expert team.

Uncategorized

Uncategorized

Hands up if you too daydream of being mortgage free and what you would do with the extra money? The best way to be mortgage-free…

Auction

Christchurch

Empowers Women

Financial Literacy

Hamilton

House Purchase

Property Investment

Rental

Wellington

Auction

Christchurch

Empowers Women

Financial Literacy

Hamilton

House Purchase

Property Investment

Rental

Wellington

The Residential Tenancies Amendment Bill passed its third reading in Parliament at the end of last year and is now coming into force. But why…

Uncategorized

Uncategorized

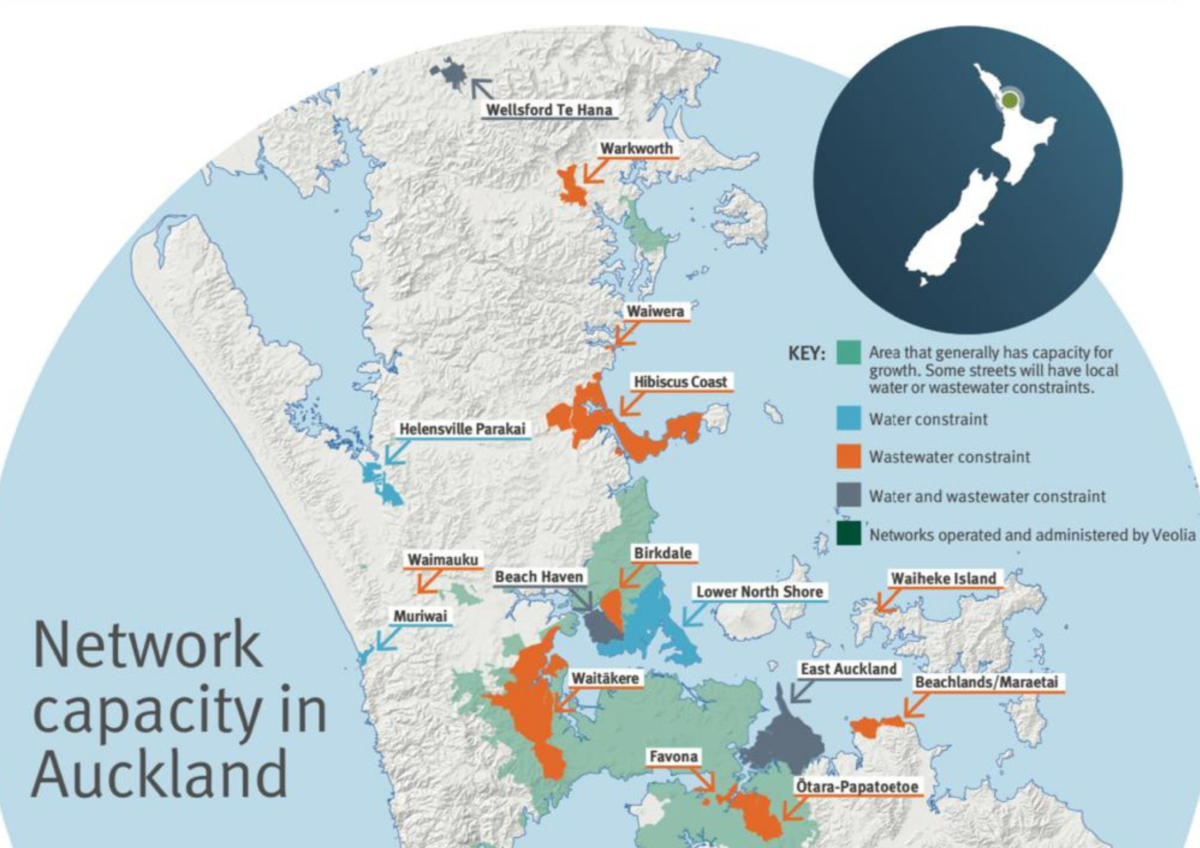

Recently parts of Auckland have been red-zoned by Watercare, Council Controlled Organisation CCO, effectively blindsiding many developers who have already bought land ready to develop.…

Subscribe and get news and information about our webpage