-

Home Loans

Home Loans

A perfect mix of home loan options with a simple online application

-

Commercial

Commercial Loans

A perfect mix of commercial loan options with a simple online application.

- About Us

- Tools

- Blogs

- Get Started

Due Diligence, Preparation and Key Points to Consider When Buying a Business or Franchise

Thinking of buying a business franchise? Before you go to the bank for a business loan, then, just as it is with a major financial decision, it is paramount that you complete due diligence to ensure you understand the full implications, liabilities and potential of owning a business.

Secured vs Unsecured Business Loans

Business loans can be provided by a bank or by another lender and usually have a loan term of around five years. It’s also important to note that for non-franchise businesses such as a dairy or superette, 50% lending from a main bank is possible, whereas lending can be up to 65% for trusted brand franchises. Regardless of the business, business loans tend to fall into three categories: secured, unsecured or a combination of both.

What is a Secured Business Loan?

As the name implies, a secured loan comes with security for the lender in some form of valuable asset such as property or accounts that can be used as collateral by the lender if you’re unable to pay the loan repayments. Compared to unsecured business loans, secured business loans tend to have lower loan terms and interest rates.

What is an Unsecured Business Loan?

Conversely, an unsecured business loan doesn’t require any asset to secure but is based on your predicted business cash flow and how creditworthy the borrower is.

Whilst it’s important to carry out due diligence for secure loans too, unsecured loans do require more due diligence from both the lender and the borrower.

As the borrower, it’s important to assess the franchise you are looking to buy:

The lender will want to know:

If you are thinking about applying for a business loan for a franchise, then speak to the expert team at Finance Hub.

Please note this blog just serves as a guide and is not financial advice, please contact our team for in depth advice by calling 0800 346 482

Uncategorized

Uncategorized

Hands up if you too daydream of being mortgage free and what you would do with the extra money? The best way to be mortgage-free…

Auction

Christchurch

Empowers Women

Financial Literacy

Hamilton

House Purchase

Property Investment

Rental

Wellington

Auction

Christchurch

Empowers Women

Financial Literacy

Hamilton

House Purchase

Property Investment

Rental

Wellington

The Residential Tenancies Amendment Bill passed its third reading in Parliament at the end of last year and is now coming into force. But why…

Uncategorized

Uncategorized

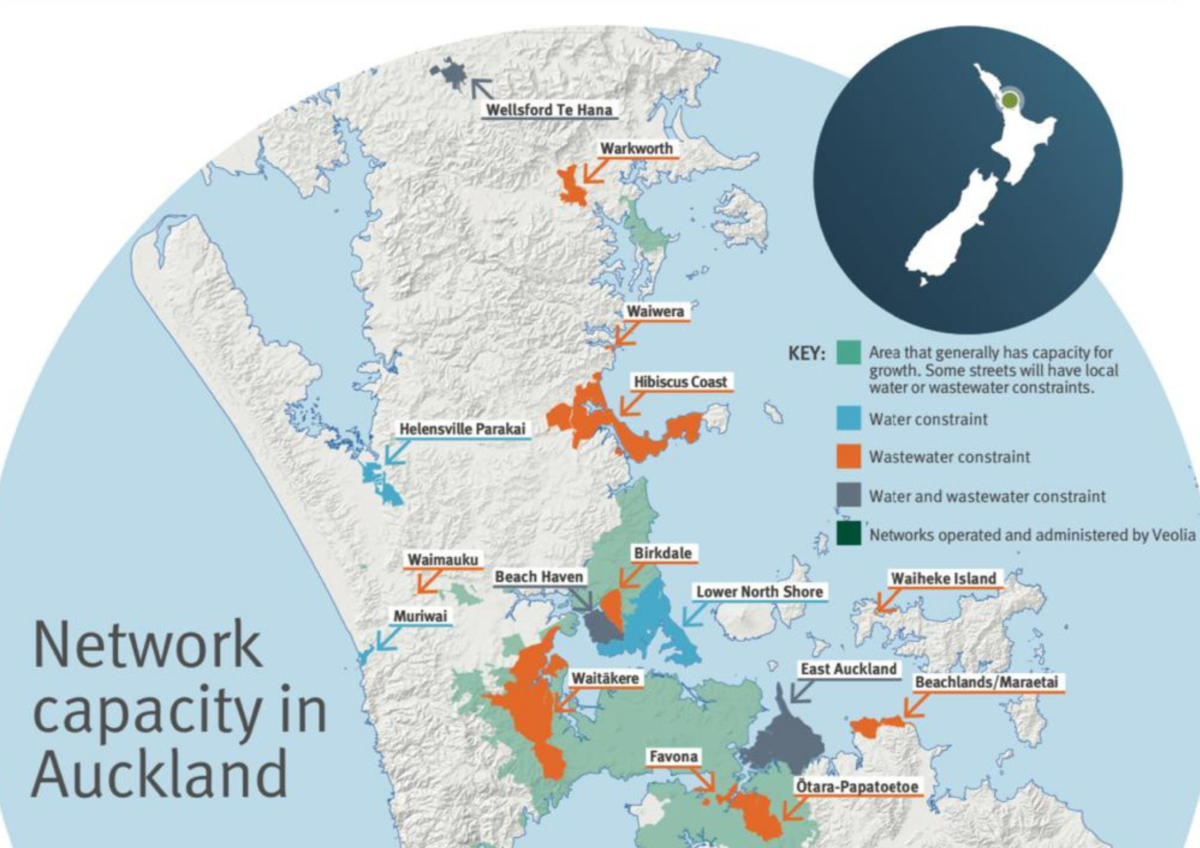

Recently parts of Auckland have been red-zoned by Watercare, Council Controlled Organisation CCO, effectively blindsiding many developers who have already bought land ready to develop.…

Subscribe and get news and information about our webpage