-

Home Loans

Home Loans

A perfect mix of home loan options with a simple online application

-

Commercial

Commercial Loans

A perfect mix of commercial loan options with a simple online application.

- About Us

- Tools

- Blogs

- Get Started

What Due Diligence Should You Carry Out Before Buying at Auction?

Regardless of how big your deposit is, it’s important to carry out due diligence on the property beforehand when buying at auction.

A lawyer or conveyancer can help you carry out the research, which includes:

The agent selling the property can provide further details, such as the terms and conditions for the auction, a land information memorandum and a builder’s report.

A builder’s report is particularly important for a plaster property, and it will need to include a weather tightness report. If this report has been provided by the vendor, it would be a sensible idea for you to arrange your own building report, which costs around $500 + GST. This will also help you determine if the property is insurable.

Preparing Your Finances

Since auctions are unconditional, you’ll need to ensure all your finances are confirmed ahead of the auction. If you’re successful, you’ll most likely need to pay a deposit of around 10% within two days of the auction.

If you’re using funds from your KiwiSaver for the deposit, you’ll need to have this money withdrawn and ready. If you’re waiting for this money to arrive, a broker might be able to arrange a temporary overdraft; however, a fee will apply, or a lawyer can also take on the undertakings.

If you’re wondering if you can buy at auction with a deposit of less than 20%, the answer is yes. However, you’ll need to complete a few additional steps.

You’ll want to apply for your financing seven to ten days before the auction and ensure that you have fulfilled any conditions, such as closing short-term liabilities, such as paying off car loans, store cards, or student loans.

For those with a deposit of less than 20%, the bank will also require you to carry out a registered valuation. This can cost between $750 and $950 + GST and take up to four working days to complete. If you require an urgent valuation, it can cost around $1250 + GST, so it is worth factoring in these costs.

It is important to note that if you win at auction without a bank-approved registered valuation and then find the property’s value is lower than what you paid for, the bank may be inclined to lend you less, or you might need a higher deposit, so again, keep this in mind.

Winning the Auction

If you are successful at the auction, you will have two working days to pay the deposit; however, prior to the auction, you can request to extend this to five working days using a variation of the agreement – you’ll need to speak with your Real Estate Agent and Lawyer about this.

Auctions can be emotionally charged places for first-time home buyers, so it is best to carefully consider all the potential risks and carry out the due diligence thoroughly.

Uncategorized

Uncategorized

Hands up if you too daydream of being mortgage free and what you would do with the extra money? The best way to be mortgage-free…

Auction

Christchurch

Empowers Women

Financial Literacy

Hamilton

House Purchase

Property Investment

Rental

Wellington

Auction

Christchurch

Empowers Women

Financial Literacy

Hamilton

House Purchase

Property Investment

Rental

Wellington

The Residential Tenancies Amendment Bill passed its third reading in Parliament at the end of last year and is now coming into force. But why…

Uncategorized

Uncategorized

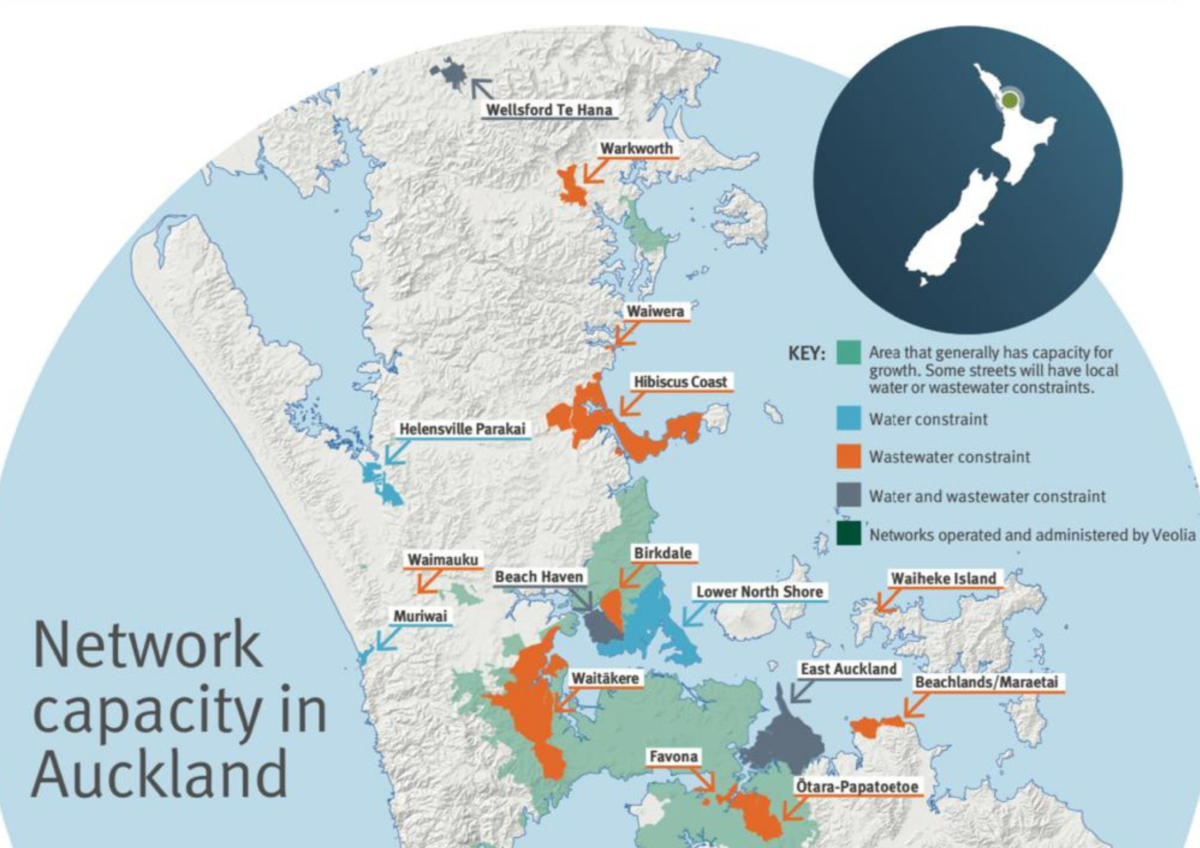

Recently parts of Auckland have been red-zoned by Watercare, Council Controlled Organisation CCO, effectively blindsiding many developers who have already bought land ready to develop.…

Subscribe and get news and information about our webpage