Buying your first home? Congratulations! It’s an exciting time, but we understand navigating the buying process can be daunting especially as it’s a big financial commitment. To help, we’ve put together this quick guide:

Before you start viewing properties, spend time calculating your budget and how much you will need to save for your deposit. For first time buyers this is usually around 20%. You might also be eligible to use funds from your KiwiSaver or receive the KiwiSaver First Home Grant.

Next it’s time to choose your lender. If you’re not sure who to choose, we can help. Your lender can give you pre-approval, so you know exactly how much you can borrow before you start looking for a property.

When you’ve found a property that you would like to purchase it’s vital that you carry out due diligence to ensure you are equipped with as much information as possible. It’s important that you complete a title search and find the land information memorandum (LIM) which provides a summary of information held by the local council such rates, consents and special conditions – a lawyer or conveyancer can help with this and other research.

Before you make an offer, most lenders will want to ensure that they have all the relevant information about the property and that you can meet any requirements, before they approve your mortgage.

If your mortgage application is successful, it’s time to make an offer. There are different sale methods such as buying by auction or negotiation. Having your mortgage approved, depends on the type of sale method. For unconditional sales (auction) your mortgage will need to be approved first, but for conditional (such as by negotiation) you can apply for your mortgage after. At Finance Hub we can recommend the best route for you to take.

After your mortgage has been approved, your offer has been accepted and you’ve met any conditions of the contract it’s time to get ready for settlement day and move into your new property!

N.B This article is just a brief guide and not financial advice, for more in-depth mortgage advice, get in touch with our team.

Want to Know More? Give Us a Call Today!

Uncategorized

Uncategorized

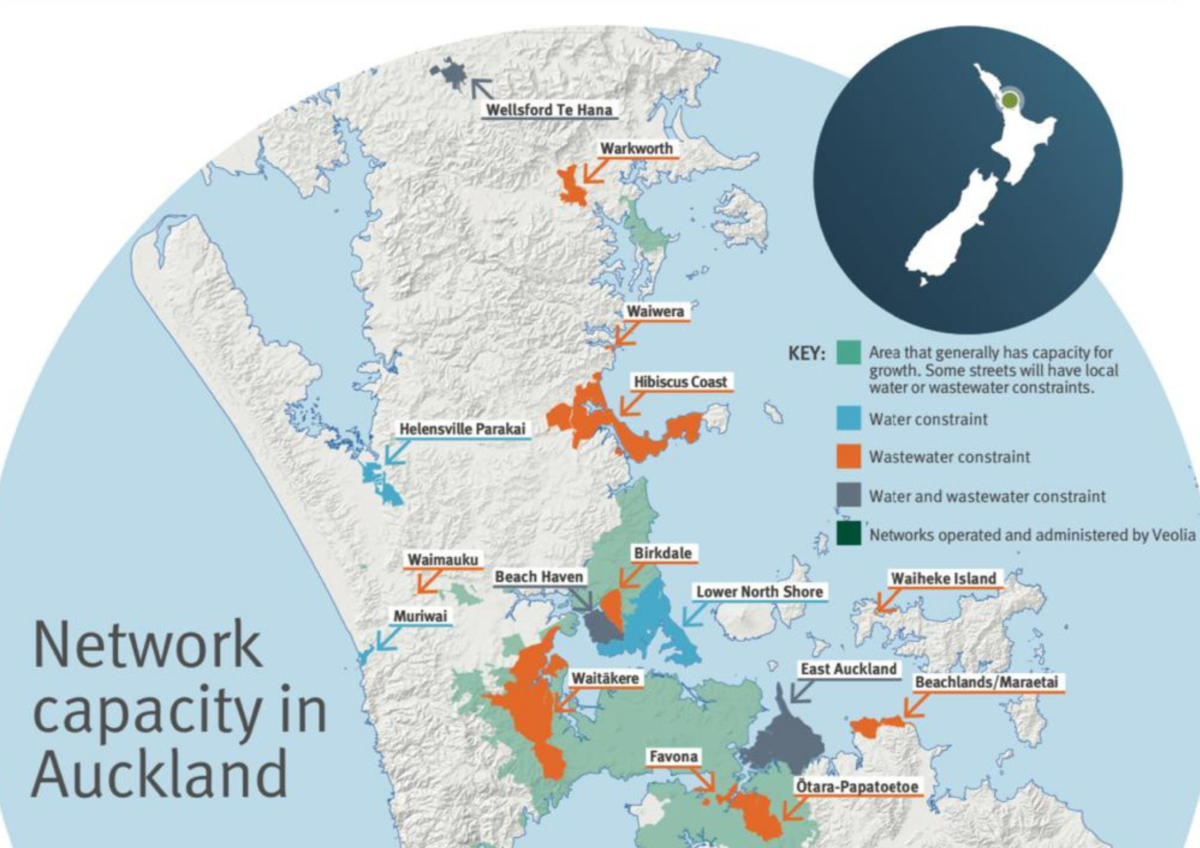

Recently parts of Auckland have been red-zoned by Watercare, Council Controlled Organisation CCO, effectively blindsiding many developers who have already bought land ready to develop.…

Uncategorized

Uncategorized

What will happen to property prices in 2025 according to the leading economists?

Auction

Financial Literacy

First Home Buyer

Hamilton

House Purchase

Interest Rate

Loan Approval

Property Investment

Property Tax

Rental

Auction

Financial Literacy

First Home Buyer

Hamilton

House Purchase

Interest Rate

Loan Approval

Property Investment

Property Tax

Rental

The fourth largest region in New Zealand, the Waikato covers over 25,000 square kilometres and includes, arguably, some of the most beautiful areas in the…

Subscribe and get news and information about our webpage