This year, the theme for International Women’s Day is #InspireInclusion and here, at Finance Hub, we believe it is crucial that women are financially literate so that they can be knowledgeable in the financial decisions that affect them, economically empowered and ultimately, included. First, though:

Simply put, financial literacy is being confident in:

– Managing your money

– Understanding key financial concepts such as savings, debt and investing

– Being confident in being able to solve financial problems that may arise.

If you’re financially literate you can make the best decisions for your own financial goals, whether that’s saving towards retirement, investing in shares, paying off your mortgage or choosing the right credit card.

Globally there are challenges that women face that mean they are at a financial disadvantage to men including: the gender pay gap, being more likely to take career breaks to care for family, and less access to education. All of which can make it difficult to build wealth and be financially independent.

Coupled with that, there is a gender gap in women’s confidence in financial literacy. In fact, a 2021 study by the Financial Services Council, found that female respondents rated their financial confidence lower than male respondents and ‘over 80% of women rate their financial wellbeing moderate, low or very low.’1

Financial literacy empowers women by:

– Optimising Earnings Through Investment

Women are more risk averse than men.’2 As such, studies show that women are more likely to save their money than invest it. An ASB report found that if women invested their additional savings ‘in an appropriate KiwiSaver fund, women aged 35-65 could collectively boost their retirement funds by around $750 million.’3 This is particularly important to avoid poverty in old age, since women are not only likely to earn less than men, but also tend to live longer.

– Increasing Financial Independence

According to Fidelity International, just over half of UK women feel financially independent, with many relying on others to pay bills.’4 Financial literacy allows you to be in control of financial decisions and included in financial discussions, even if you are still reliant on others for financial support.

– Helping to Manage Financial Challenges

A report found that women were almost twice as likely to lose their job during the pandemic.’5 Being more financially literate will help in times of financial crisis, such as losing a job or when a partner who has always managed the finances passes away or leaves.

If you think that you could benefit from increasing your financial confidence here are some steps that we recommend:

Building up Savings to Have Six Months of Emergency Funding

This will not only give you more options but can be used: in old age, to cover unexpected costs, to help during career breaks and in financial emergencies.

Having Your Own Separate Bank Account

This isn’t to say you shouldn’t also have a joint account with your partner if you want to, but by having your own separate savings bank account you are keeping financially independent, it allows you to save for your own goals and it provides you with a buffer in emergencies.

Get Help From a Financial Planner

If you’re not feeling confident in investing and building wealth, get advice from a trusted financial planner, who can help you reach your goals, make suggestions and help you gain the confidence you need to manage your money.

Stay Involved in Financial Decisions

Play an active role in your personal finances. When it comes to choosing a retirement plan, making investments or taking out a loan, make sure to be included in all decisions and read any documents that need to be signed.

Keep Learning

Make it a priority to increase your financial knowledge and learn about the decisions and changes that will affect you financially both in your personal life and in your work environment. Having the knowledge is the best way to help you make financially sound decisions.

Understand Differences Between Academically Sound and Financially Sound Choices

We want to stress the importance of everyone being financially literate, so if you are after financial advice, get in touch with us here.

N.B The views expressed in this blog are that of Falgun Patel and Roshni Patel, licenced mortgage advisors and directors of Finance Hub.

1https://f.hubspotusercontent10.net/hubfs/7422267/FSC%20Corporate/Research%20Reports/PC13583%20Money%20%20You%20Women%20and%20Finance_FINAL.pdf

2https://www.asb.co.nz/documents/media-centre/media-releases/women-better-off-day-to-day-but-miss-out-on-750-million-at-retirement.html

3https://www.asb.co.nz/documents/media-centre/media-releases/women-better-off-day-to-day-but-miss-out-on-750-million-at-retirement.html

4https://www.fidelity.co.uk/markets-insights/personal-finance/women-money/how-financially-independent-do-you-feel-right-now/

5https://www.wealthihernetwork.com/2022/the-changing-face-of-womens-wealth/

Uncategorized

Uncategorized

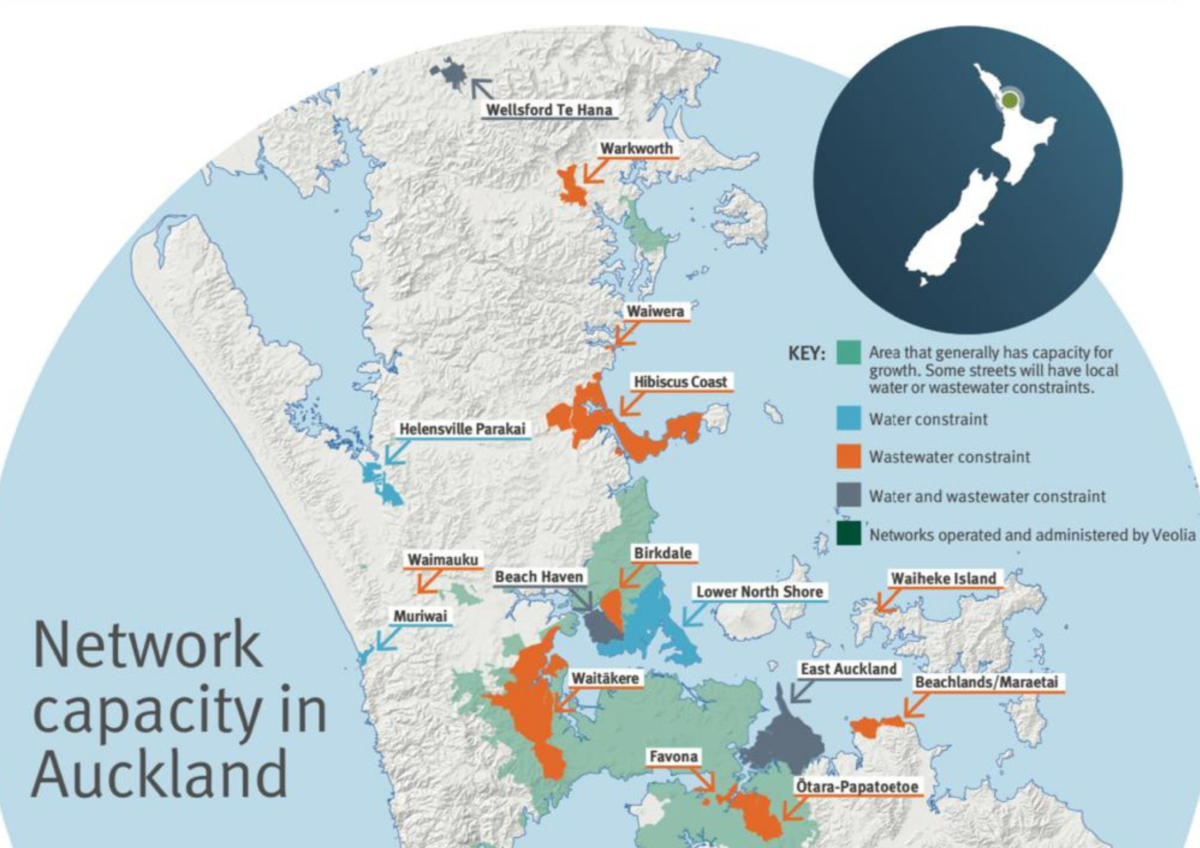

Recently parts of Auckland have been red-zoned by Watercare, Council Controlled Organisation CCO, effectively blindsiding many developers who have already bought land ready to develop.…

Uncategorized

Uncategorized

What will happen to property prices in 2025 according to the leading economists?

Auction

Financial Literacy

First Home Buyer

Hamilton

House Purchase

Interest Rate

Loan Approval

Property Investment

Property Tax

Rental

Auction

Financial Literacy

First Home Buyer

Hamilton

House Purchase

Interest Rate

Loan Approval

Property Investment

Property Tax

Rental

The fourth largest region in New Zealand, the Waikato covers over 25,000 square kilometres and includes, arguably, some of the most beautiful areas in the…

Subscribe and get news and information about our webpage