N.B The views expressed in this blog are that of Falgun Patel and Roshni Patel, licenced mortgage advisors and directors of Finance Hub.

The Reserve Bank (RBNZ) has just released its first Monetary Policy Statement for 2024 which saw them hold the OCR at 5.50% (something that many economists, such as Tony Alexander predicted), suggesting that RBNZ is confident that they will get on top of inflation reducing to between 1% to 3% with 2% being the sweet spot.

In the Short Term

In the immediate future, short term lending rates are unlikely to change, given that the banks’ own cost of borrowing from RBNZ has not changed.

In the Mid to Long Term

However, in the mid to long term, if we look at RBNZ’s key forecast variables, they are predicting that CPI inflation will get within range by September 2024, reaching 2% by December 2025. Alongside the reduction in inflation rates they are forecasting that the OCR will first increase 10 basis points between now and June 2024 before slowly starting to decrease over the next three years until it reaches 3.2% in the March 2027 quarter.1

This suggests that mid to long term rates could start to ease, as banks reduce borrowing rates.

It should be noted that RBNZ made their predictions based on the last government’s 2023 budget and so there is some un1certainty around the new government’s spending, and how this may impact monetary policy and in turn interest rates.

The Role of the Global Economy

What isn’t so easy to predict is just how events will play out on the global stage and how this could affect international markets and the world economy. Take for example the current situation in the Red Sea and how this may affect global shipping rates and in turn consumer prices, driving up inflation.2

Predicting interest rates is, only ever that, a prediction, and whilst we haven’t seen a hike in the OCR, we can’t be certain that this won’t happen.

If you need advice concerning your finances, get in touch with the Finance Hub team here.

1https://www.rbnz.govt.nz/-/media/project/sites/rbnz/files/publications/monetary-policy-statements/2024/feb/mps-feb-2024.pdf

2https://time.com/6553141/red-sea-houthi-attacks-consumer-prices-cost/

Uncategorized

Uncategorized

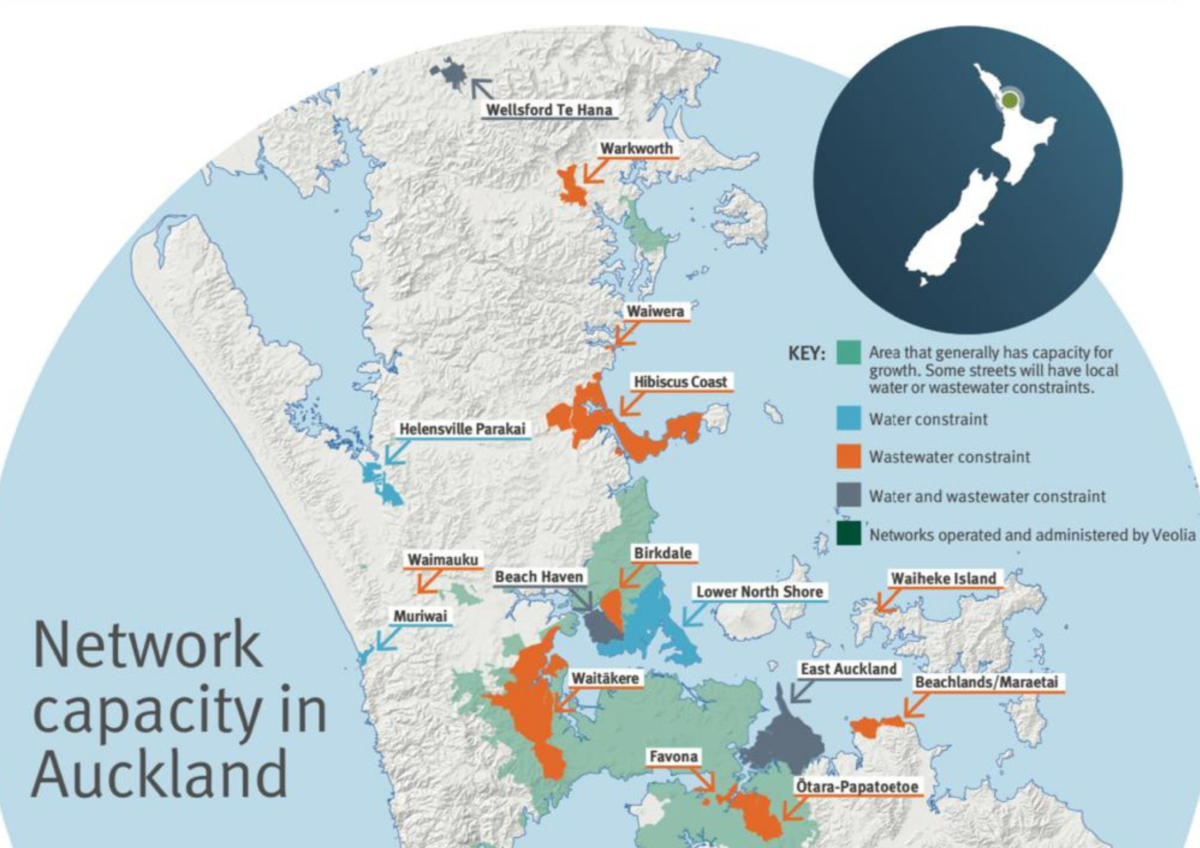

Recently parts of Auckland have been red-zoned by Watercare, Council Controlled Organisation CCO, effectively blindsiding many developers who have already bought land ready to develop.…

Uncategorized

Uncategorized

What will happen to property prices in 2025 according to the leading economists?

Auction

Financial Literacy

First Home Buyer

Hamilton

House Purchase

Interest Rate

Loan Approval

Property Investment

Property Tax

Rental

Auction

Financial Literacy

First Home Buyer

Hamilton

House Purchase

Interest Rate

Loan Approval

Property Investment

Property Tax

Rental

The fourth largest region in New Zealand, the Waikato covers over 25,000 square kilometres and includes, arguably, some of the most beautiful areas in the…

Subscribe and get news and information about our webpage