N.B The views expressed in this blog are that of Falgun Patel and Roshni Patel, licenced mortgage advisors and directors of Finance Hub.

The Reserve Bank’s (RBNZ) recent Monetary Policy Statement revealed that the Official Cash Rate (OCR) was being kept at the same level, which suggests that the RBNZ is more confident that they will be able to get the CPI inflation rate down to 1%- 3%, something they predict they can do by September 2024. The RBNZ has forecast that from December 2025 through to March 2027 inflation will sit at 2%. As inflation falls, interest rates are likely to decrease too, which could increase house prices. [1]

Since the end of 2022, New Zealand has seen an increase in net migration, the RBNZ reports that migration added 2.4% per annum to the population at the end of 2023. [2] As the population continues to increase, there will likely be further demand for property, potentially pushing up the prices. That said, currently, house prices have only increased slightly, unlike rents, which have seen substantial growth.[3] With more workers coming into New Zealand, this could help the construction industry, which has slowed.

There’s a mixed bag of news when it comes to construction. On the plus side building costs seem to have flattened out in quarter four of 2023. On the downside, the number of building consents is still declining, meaning there are not enough houses in the market to meet demand, in turn driving prices up.[4]

It’s worth considering that whilst construction levels have decreased and net migration has increased, house prices have declined broadly in line with the increase of the OCR, suggesting that interest rates are the determining factor in house prices in New Zealand.

Need help with your finances or looking for mortgage advice? Get in touch with our team here.

[1] https://www.rbnz.govt.nz/-/media/project/sites/rbnz/files/publications/monetary-policy-statements/2024/feb/mps-feb-2024.pdf

[2] https://www.rbnz.govt.nz/-/media/project/sites/rbnz/files/publications/monetary-policy-statements/2024/feb/mps-feb-2024.pdf

[3] https://www.rbnz.govt.nz/-/media/project/sites/rbnz/files/publications/monetary-policy-statements/2024/feb/mps-feb-2024.pdf

[4] https://www.interest.co.nz/property/126248/number-new-homes-being-consented-down-36-just-over-two-years

Uncategorized

Uncategorized

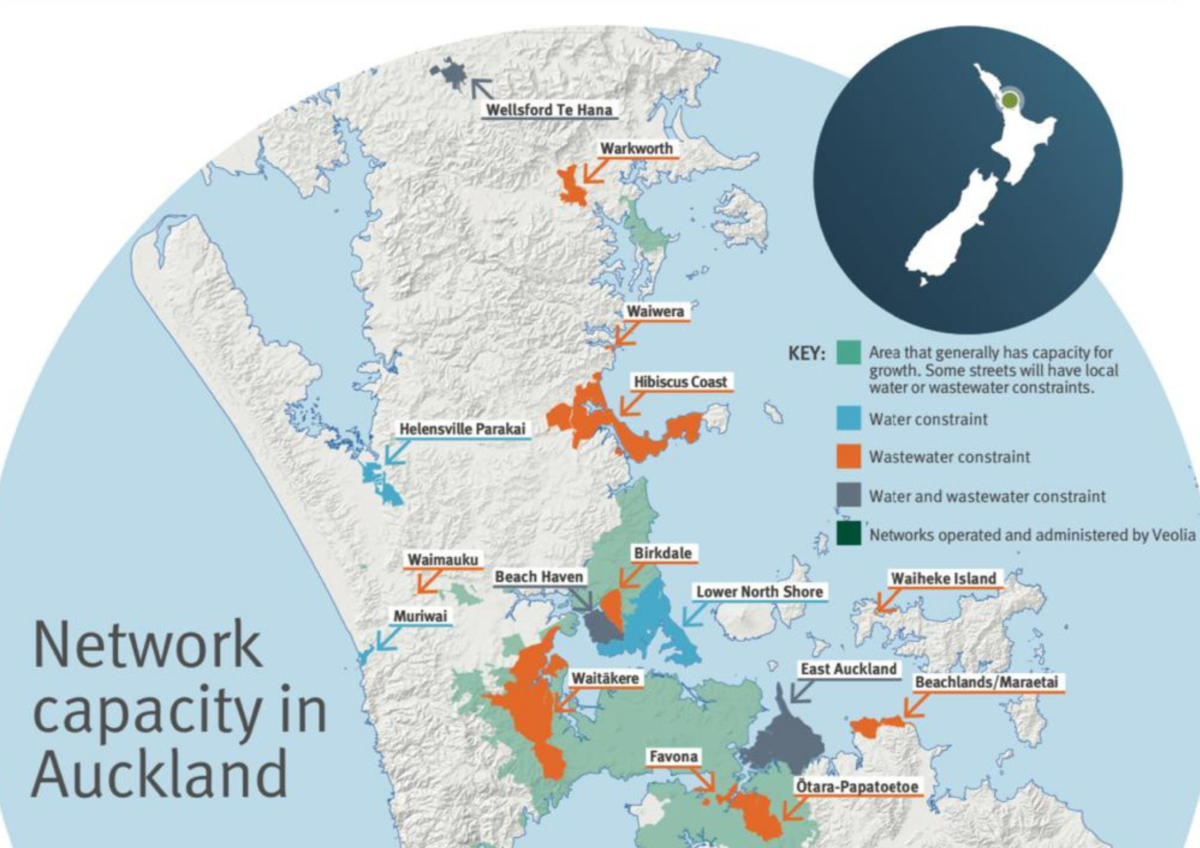

Recently parts of Auckland have been red-zoned by Watercare, Council Controlled Organisation CCO, effectively blindsiding many developers who have already bought land ready to develop.…

Uncategorized

Uncategorized

What will happen to property prices in 2025 according to the leading economists?

Auction

Financial Literacy

First Home Buyer

Hamilton

House Purchase

Interest Rate

Loan Approval

Property Investment

Property Tax

Rental

Auction

Financial Literacy

First Home Buyer

Hamilton

House Purchase

Interest Rate

Loan Approval

Property Investment

Property Tax

Rental

The fourth largest region in New Zealand, the Waikato covers over 25,000 square kilometres and includes, arguably, some of the most beautiful areas in the…

Subscribe and get news and information about our webpage