-

Home Loans

Home Loans

A perfect mix of home loan options with a simple online application

-

Commercial

Commercial Loans

A perfect mix of commercial loan options with a simple online application.

- About Us

- Tools

- Blogs

- Get Started

What will happen to property prices in 2025 according to the leading economists?

What will happen to property prices in 2025 according to the leading

economists?

We all know the, somewhat unrealistic, saying, ‘New Year, new me’ but what about ‘New Year, new property market’? Doesn’t have quite the same ring to it does it? And when we take a look at what the experts have been saying, it doesn’t seem to entirely ring true either.

Because in short, whilst we can expect an increase in property prices in 2025, growth and recovery, as independent economist Tony Alexander predicts, will be relatively mild; a prediction also reiterated by Mike Jones, Chief Economist at BNZ when he spoke to Mortgage HQ.

As to how much house prices will increase, looking at the banks’ predictions it is around 5-7% with ANZ and Kiwibank at 6% and Westpac at the higher end with 8.2%.

In August 2024, RBNZ started to reduce the OCR, first from 5.5% in June to 5.25% in August then again to 4.75% in October and finally to 4.25% in November. The next update from RBNZ is coming in February and Tony Alexander (speaking on the Shared Lunch podcast) forecasted that we could see RBNZ cutting the OCR by another 0.5%. However, he warns that we shouldn’t be too optimistic yet and expect further dramatic cuts, rather we can expect it to take around 18 months and that by the end of 2026 it will be 3%.

These lower interest rates should, in theory, encourage spending, attract investors, boost the economy and ultimately drive house prices up. As Kiwibank’s Chief Economist, Jarrod Kerr said, ‘Interest rates are the largest driver of house prices. Falling interest rates will support the market and we expect steady gains in house prices from here.’ This is echoed in Westpac’s October 2024 Economic Overview, ‘Lower interest rates are laying the basis for a solid recovery in the housing market.’

That said there is still some hesitancy as to how much the economy will grow. Tony Alexander, said although optimism is high amongst businesses and investors that interest rates will fall away, there is a risk that they will act too soon or overcommit when instead they should continue to look at cost cutting and becoming more efficient as recovery will be slow.

When investors do begin investing again, Tony Alexander suggests that with many houses on the market investors will buy existing properties that they can improve to increase yield, rather than new houses (which are costly to build) particularly townhouses which seem to be in oversupply in some areas. However he believes this will change later down the track.

What are the factors affecting the property market?

The Labour Market:

Currently New Zealand’s labour market is weakened and, naturally, with job insecurity comes a hesitancy in big purchases such as houses. In the last update (November 2024) the official unemployment rate for New Zealand was 4.8% which is equivalent to 148,000 people, however in their November/December New Zealand Property Focus, ANZ predicts that the unemployment rate will continue to a peak of 5.5% in mid 2025. If this is the case, we can expect recovery in the housing market to be slow.

Investors and Developers

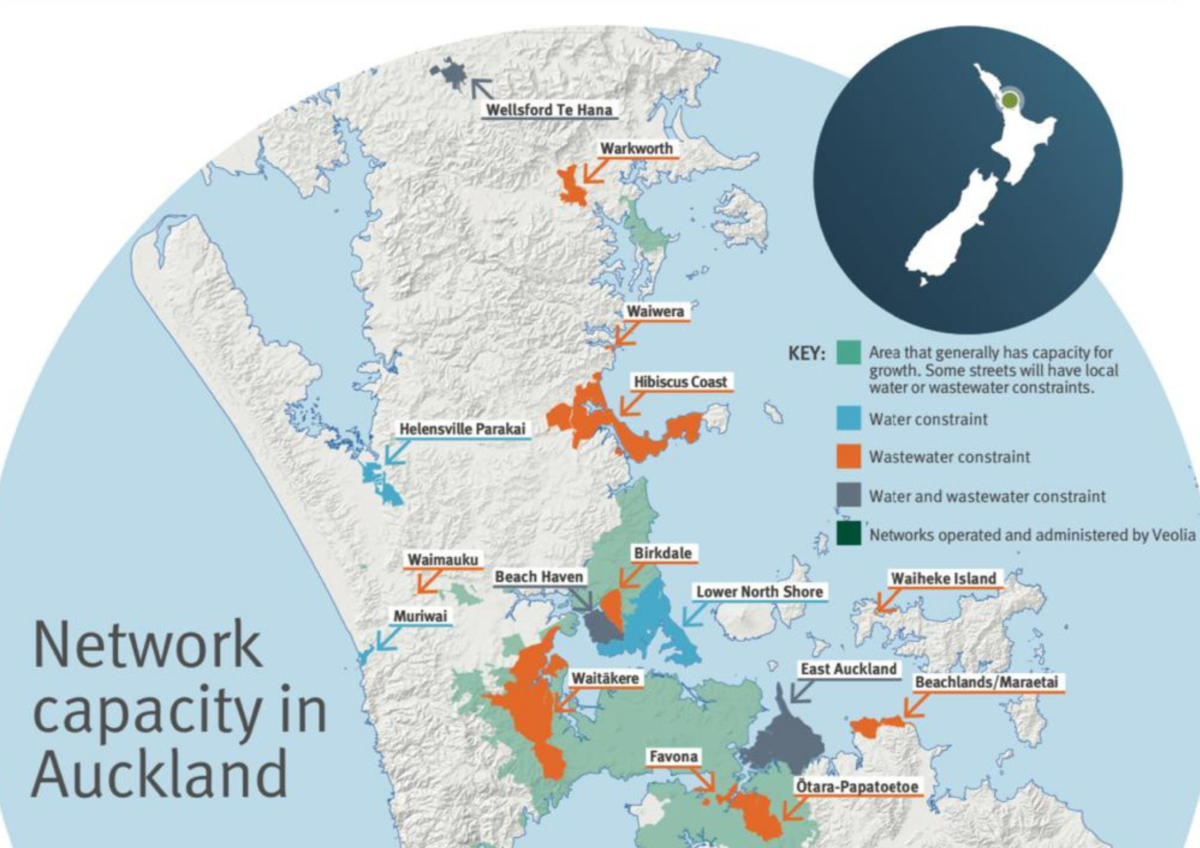

The new Brightline Test and restored interest deductions will hopefully entice investors to return back to the market. With a ‘chronic shortage of housing in Aotearoa’, Jarrod Kerr says we need to encourage investors back so that developers follow. However, new constraints such as those imposed by Watercare in Auckland, means that developable land is becoming harder to come by, making land that is available more valuable, coupled with high construction costs, house prices remain high.

Migration and Population Growth

Currently we have a housing shortage, but as migration eases off, ANZ forecasts that ‘the annual net inflow falls to around 15k by the middle of next year’, if the outflow was to remain elevated, there could be a case where there is a more supply than demand which would lower house prices.

The World Stage

We need to take into consideration the world stage and how external factors play out and affect New Zealand. For example, how will the likes of the Trump presidency, international trade and the rise of cryptocurrencies affect inflation and interest rates globally.

Of course, these are just forecasts, and whilst everyone can make informed predictions, we can’t say anything for certain. Who knows, perhaps house prices will increase more, or maybe international external factors will cause prices to decrease.

What we can say however, is that if you’re looking for an expert team with the experience and proficiency to help you attain your monetary goals, get in touch with The Finance Hub.

Email us at finance@financehub.co.nz or call us on 0800 346 482.

N.B This blog is purely informative and does not serve as financial advice.

Uncategorized

Uncategorized

Hands up if you too daydream of being mortgage free and what you would do with the extra money? The best way to be mortgage-free…

Auction

Christchurch

Empowers Women

Financial Literacy

Hamilton

House Purchase

Property Investment

Rental

Wellington

Auction

Christchurch

Empowers Women

Financial Literacy

Hamilton

House Purchase

Property Investment

Rental

Wellington

The Residential Tenancies Amendment Bill passed its third reading in Parliament at the end of last year and is now coming into force. But why…

Uncategorized

Uncategorized

Recently parts of Auckland have been red-zoned by Watercare, Council Controlled Organisation CCO, effectively blindsiding many developers who have already bought land ready to develop.…

Subscribe and get news and information about our webpage