Revolving Loans Vs. Offset Loans: Which is Best For You? A mortgage is one of the biggest (if not, the biggest) financial commitments we’ll make in our lifetime. And when it comes to paying back your mortgage, you’re also looking at paying a lot of interest. So it makes sense to try and bring down the interest charges and pay off your mortgage more quickly. Two common options for this are revolving loans and offset loans. But what are they? What are their pros and cons? And which is best for you?

What is a revolving loan?

A revolving loan allows you to reduce your mortgage and interest payments by putting all your money: your savings, salary and mortgage in one account.

However, as you take money back out to pay for things such as groceries and utilities, your balance will come back up and with it, your interest repayments.

Pros of a revolving loan:

Cons of a revolving loan:

Who would benefit from a revolving loan?

If your income varies month to month a revolving loan allows you to make repayments to your mortgage in prosperous months, whilst still allowing you to dip into your savings in months where you make less. Equally, if you have a high salary and a high amount of savings, then you would also benefit from a revolving loan as you could quickly reduce your mortgage and interest payments.

What is an offset loan?

An offset loan uses your savings in designated accounts to reduce the interest payments on your mortgage.

For example if your mortgage is $600,000 and you have an account with $30,000 of savings, then rather than pay interest on the full mortgage you would pay interest on $570,000 ($600,000 minus your savings).

Pros of an offset loan:

Cons of an offset loan:

Who would benefit from an offset loan?

If you prefer to keep your savings and mortgage separate then an offset loan gives you this option. Plus, if you have a large amount of savings accruing little interest, you can make your savings reduce your interest payments whilst still being available to use when needed.

Should you choose a revolving loan or an offset loan?

The answer to this is, it depends! It depends on what works best for you. If you tend to have a more variable income then a revolving loan could be the right option, whereas if you have a high salary or a large amount of savings then a revolving loan could be better.

It’s important to speak with a financial advisor so that you can make the most informed decision for your circumstances and how you are looking to pay for your home or build your property portfolio.

Please note this is just general information, for advice tailored to you, get in touch with the team at Finance Hub by calling 0800 346 482 or contacting us here.

Auction

Christchurch

Empowers Women

Financial Literacy

Hamilton

House Purchase

Property Investment

Rental

Wellington

Auction

Christchurch

Empowers Women

Financial Literacy

Hamilton

House Purchase

Property Investment

Rental

Wellington

The Residential Tenancies Amendment Bill passed its third reading in Parliament at the end of last year and is now coming into force. But why…

Uncategorized

Uncategorized

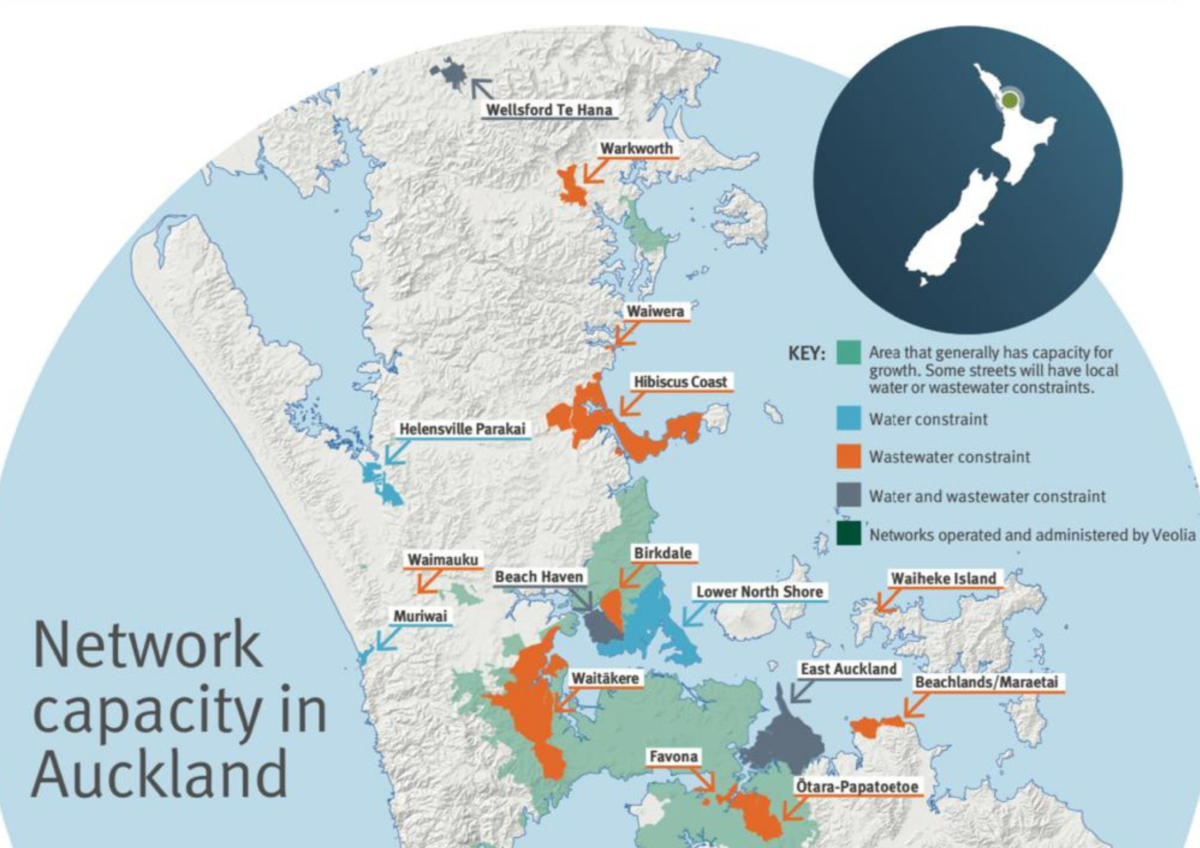

Recently parts of Auckland have been red-zoned by Watercare, Council Controlled Organisation CCO, effectively blindsiding many developers who have already bought land ready to develop.…

Uncategorized

Uncategorized

What will happen to property prices in 2025 according to the leading economists?

Subscribe and get news and information about our webpage