-

Home Loans

Home Loans

A perfect mix of home loan options with a simple online application

-

Commercial

Commercial Loans

A perfect mix of commercial loan options with a simple online application.

- About Us

- Tools

- Blogs

- Get Started

If you’re a buyer looking at a new build, chances are you’ve heard of a sunset clause, but what are they exactly? How are they beneficial both to you, the buyer, and the developer? And what should you look out for when setting up a sunset clause?

What is a sunset clause?

Part of the sale and purchase agreement, a sunset clause legally allows a buyer or developer to cancel a New Build contract if the construction significantly runs over the completion date. This will be a predetermined date such as the completion date + X number of months.

Sunset clauses can be both one or two-ways.

One-way sunset clause: When only one of the parties can legally end the contract, so either the buyer OR the developer.

Two-way sunset clause: When either party can legally cancel the contract, meaning both the buyer AND the developer can choose to end the contract.

Why might a developer choose to have a sunset clause?

There are a couple of reasons why a developer might choose to have a sunset clause.

Firstly there could be delays that are entirely out of their control, such as the Covid-19 pandemic, that significantly slows down construction, in these cases having a sunset clause allows them to legally pull the plug on the contract.

Secondly, and divisively, is that house prices could rise and in that case the developer could cancel the contract and then sell the house at a higher rate.

Why should a buyer have a sunset clause?

Without a sunset clause the buyer could powerlessly be tied into a never-ending contract or a contract that can only be cancelled by the developer.

You don’t want to be stuck waiting years for your new build to be finished without any legal way to end the contract, particularly if the housing market changes in the meantime and interest rates begin to increase beyond your means.

Nor do you want the property that you have put a deposit on, to be sold to someone else for a higher price, meaning that you lose out on potential future earnings and now have to pay for to get your property back or potentially more for another property.

What due diligence should be carried out when setting up a sunset clause?

Whilst a sunset clause should be organised between your lawyer and the developer’s lawyer it always pays to carry out your due diligence.

Key considerations include:

A sunset clause can provide security for both the buyer and developer but it is important that you engage a lawyer to undertake the due diligence.

Please note that this is just general information, for more specific advice please get in touch with the team at Finance Hub by calling 0800 346 482

Uncategorized

Uncategorized

Hands up if you too daydream of being mortgage free and what you would do with the extra money? The best way to be mortgage-free…

Auction

Christchurch

Empowers Women

Financial Literacy

Hamilton

House Purchase

Property Investment

Rental

Wellington

Auction

Christchurch

Empowers Women

Financial Literacy

Hamilton

House Purchase

Property Investment

Rental

Wellington

The Residential Tenancies Amendment Bill passed its third reading in Parliament at the end of last year and is now coming into force. But why…

Uncategorized

Uncategorized

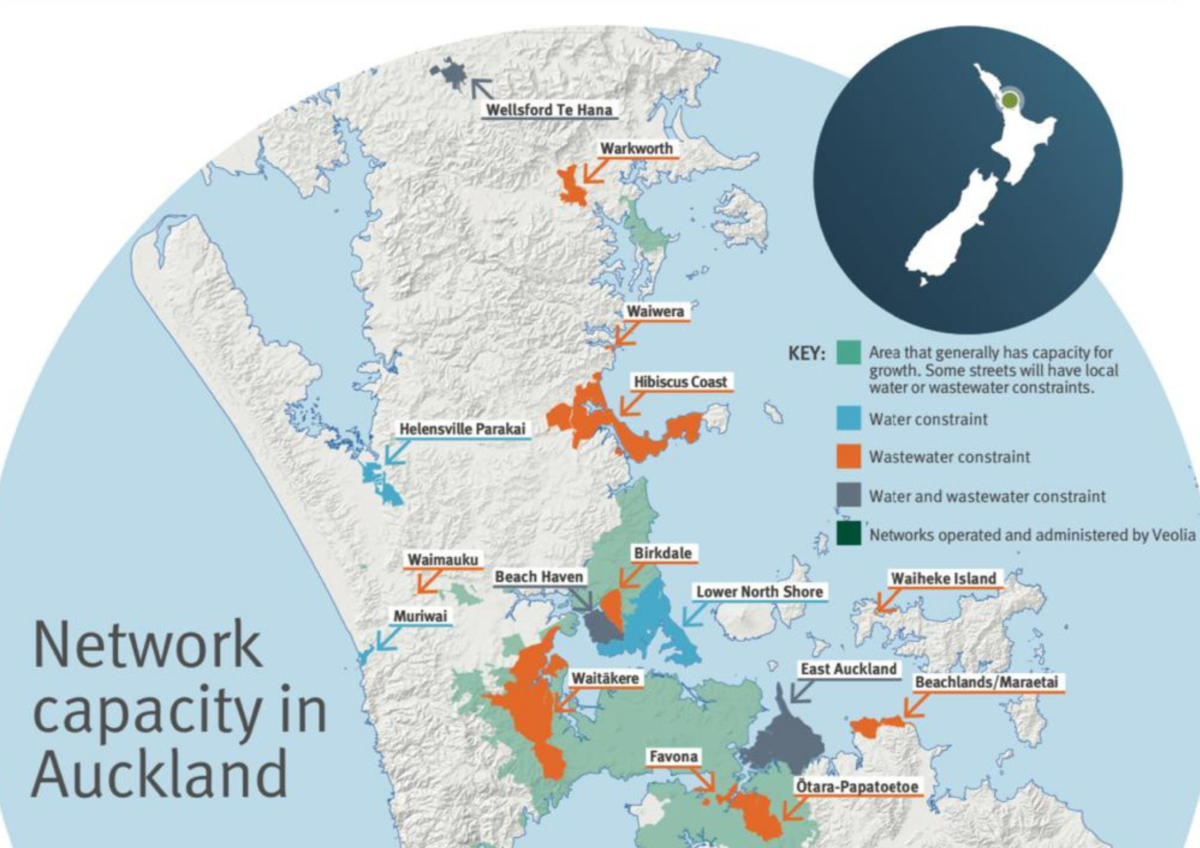

Recently parts of Auckland have been red-zoned by Watercare, Council Controlled Organisation CCO, effectively blindsiding many developers who have already bought land ready to develop.…

Subscribe and get news and information about our webpage