The property market is constantly (if slowly) moving through a cycle which is made up of four stages: boom or upturn, peak, downturn and trough. Where the property market sits in the cycle is due to economic factors such as migration, confidence in the market, interest rates and economic policies.

What are the four stages of the property cycle?

The boom refers to the stage of the cycle when the market is recovering after a trough period. During the boom, prices rise as there are more buyers than sellers, which drives up demand and, subsequently, prices.

If you’re buying during this time, you want to buy early during the upturn before prices reach their peak. If you’re selling, you want to hold on and sell closer to the peak – although this can be hard to predict.

Following the boom comes the peak. This is when demand is at its highest, and so are prices. Prices can plateau here before moving on to the next stage.

While now is a good time to sell, for buyers, it can be tough since there is a lot of competition. You’ll likely need a higher deposit since prices are higher. If you do buy at this time, it’s unlikely you’ll want to sell your house for a loss, so you’ll want to hold off selling until the cycle returns to its peak.

With the demand for houses high during the peak, sellers become confident and list their homes. As more homes are listed, demand drops, and so do prices. That said, interest rates often increase during a downturn.

Since no one knows how low prices will go, now is the time to negotiate whether you’re buying or selling.

The opposite to the peak is the trough. This is when prices have reached their lowest point and, like the peak, they plateau or flatten out. Now is a great time to buy if you get in there early, however, as prices remain low buyers become confident and decide to buy, increasing demand, which in turn leads us back to a boom and the cycle begins all over again.

N.B This article is just a brief guide and not financial advice, for more in-depth advice about properties and mortgages get in touch with our team.

Auction

Christchurch

Empowers Women

Financial Literacy

Hamilton

House Purchase

Property Investment

Rental

Wellington

Auction

Christchurch

Empowers Women

Financial Literacy

Hamilton

House Purchase

Property Investment

Rental

Wellington

The Residential Tenancies Amendment Bill passed its third reading in Parliament at the end of last year and is now coming into force. But why…

Uncategorized

Uncategorized

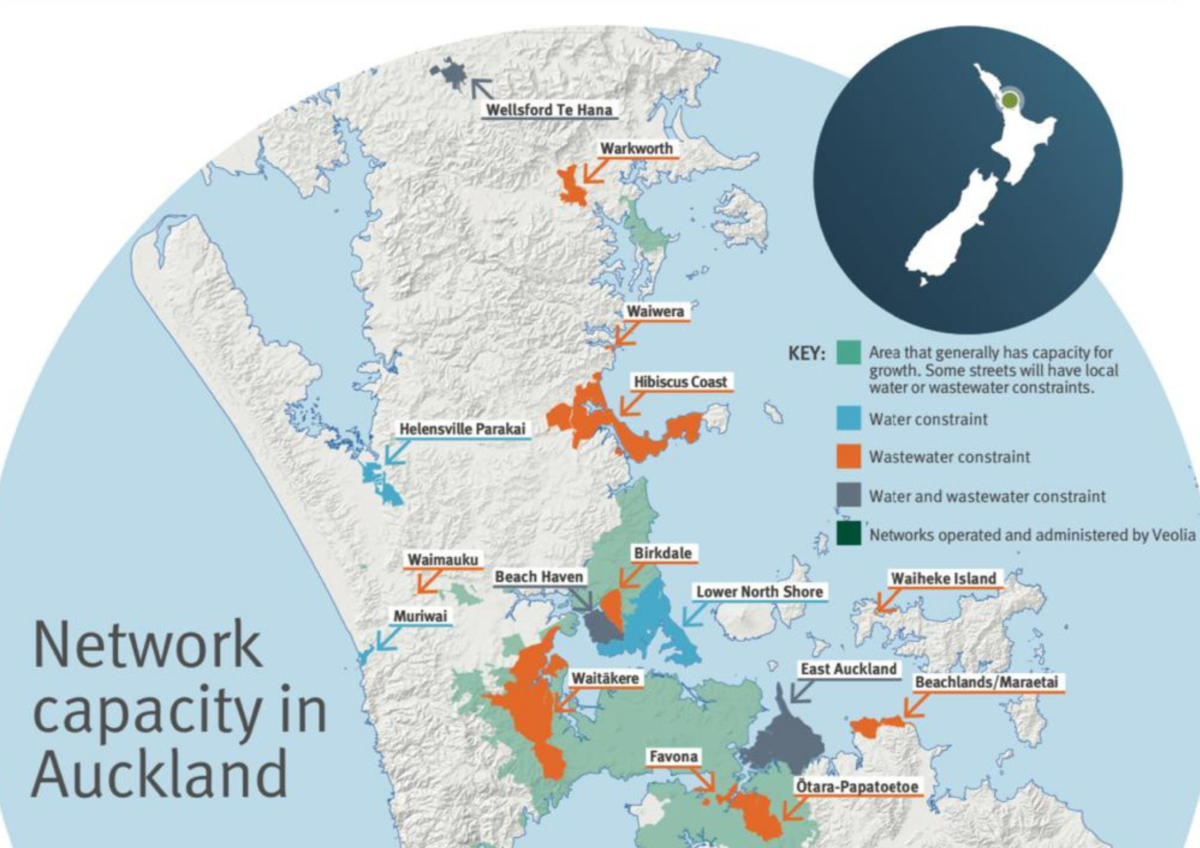

Recently parts of Auckland have been red-zoned by Watercare, Council Controlled Organisation CCO, effectively blindsiding many developers who have already bought land ready to develop.…

Uncategorized

Uncategorized

What will happen to property prices in 2025 according to the leading economists?

Subscribe and get news and information about our webpage