-

Home Loans

Home Loans

A perfect mix of home loan options with a simple online application

-

Commercial

Commercial Loans

A perfect mix of commercial loan options with a simple online application.

- About Us

- Tools

- Blogs

- Get Started

The Reserve Bank has just announced that they are setting new debt-to-income (DTI) rules for banks on home lending that will come into effect on the 1st July 2024.

Let’s take a look at what they are and how they will affect borrowers.

What is a DTI?

A DTI is used by banks and lenders to limit how much you can borrow based on your income and debt.

The maximum amount you can borrow is:

Annual income before tax x DTI ratio

These are put in place to ensure that banks are responsible with their lending and don’t over lend during economic booms.

What are the new restrictions?

From the 1st July 2024 the new restrictions mean that banks will be able to make a maximum of:

Will you be affected by the new DTI restrictions?

Potentially. You will only be affected if you are asking to borrow more than six times your yearly income before tax if you’re an owner-occupier or seven times if you’re an investor.

For example:

If a family has a yearly income before tax of $150,000 and a debt of $25,000 they can borrow up to $875,000 (their yearly income multiplied by six minus their debt) before they would be considered as a high DTI.

In this case they wouldn’t be affected.

However, if they wanted to borrow over $875,000 they could be affected by these new restrictions.

This isn’t to say that banks wouldn’t lend them the money, but it does depend on how much high DTI lending they have already done in a certain period.

It’s important to note:

– This doesn’t take into account deposits, this only refers to how much you can borrow.

– Banks will have their own lending criteria and other rules that might affect how much they are willing to lend you.

Are there any exemptions?

Yes there are some exemptions and it is important to speak with your bank to see the full list of exemptions to determine if you are exempt, but some exemptions include: Kāinga Ora loans, bridging finance and property remediation.

N.B This article is just a brief guide and not financial advice, for more in-depth mortgage advice, get in touch with our team.

Uncategorized

Uncategorized

Hands up if you too daydream of being mortgage free and what you would do with the extra money? The best way to be mortgage-free…

Auction

Christchurch

Empowers Women

Financial Literacy

Hamilton

House Purchase

Property Investment

Rental

Wellington

Auction

Christchurch

Empowers Women

Financial Literacy

Hamilton

House Purchase

Property Investment

Rental

Wellington

The Residential Tenancies Amendment Bill passed its third reading in Parliament at the end of last year and is now coming into force. But why…

Uncategorized

Uncategorized

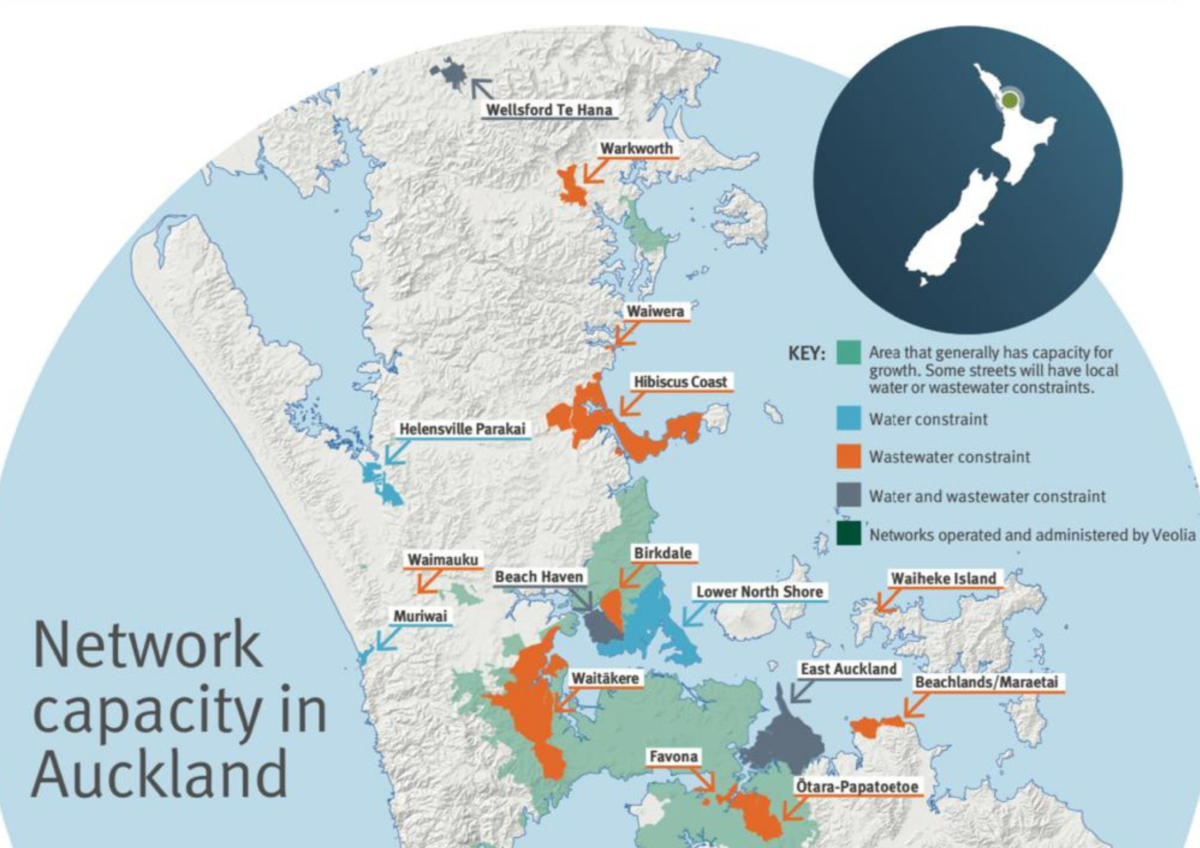

Recently parts of Auckland have been red-zoned by Watercare, Council Controlled Organisation CCO, effectively blindsiding many developers who have already bought land ready to develop.…

Subscribe and get news and information about our webpage