-

Home Loans

Home Loans

A perfect mix of home loan options with a simple online application

-

Commercial

Commercial Loans

A perfect mix of commercial loan options with a simple online application.

- About Us

- Tools

- Blogs

- Get Started

In short, yes, the amount a bank is willing to lend you does vary. Why the amount varies depends on a number of factors. Every bank has its own set of criteria, and lending policy when it assesses your home loan application.

Here are four criteria that can vary between banks:

In conclusion, it’s essential to reach out to a Mortgage Adviser who can help determine the best lending amount to meet your financial goals.

Uncategorized

Uncategorized

Hands up if you too daydream of being mortgage free and what you would do with the extra money? The best way to be mortgage-free…

Auction

Christchurch

Empowers Women

Financial Literacy

Hamilton

House Purchase

Property Investment

Rental

Wellington

Auction

Christchurch

Empowers Women

Financial Literacy

Hamilton

House Purchase

Property Investment

Rental

Wellington

The Residential Tenancies Amendment Bill passed its third reading in Parliament at the end of last year and is now coming into force. But why…

Uncategorized

Uncategorized

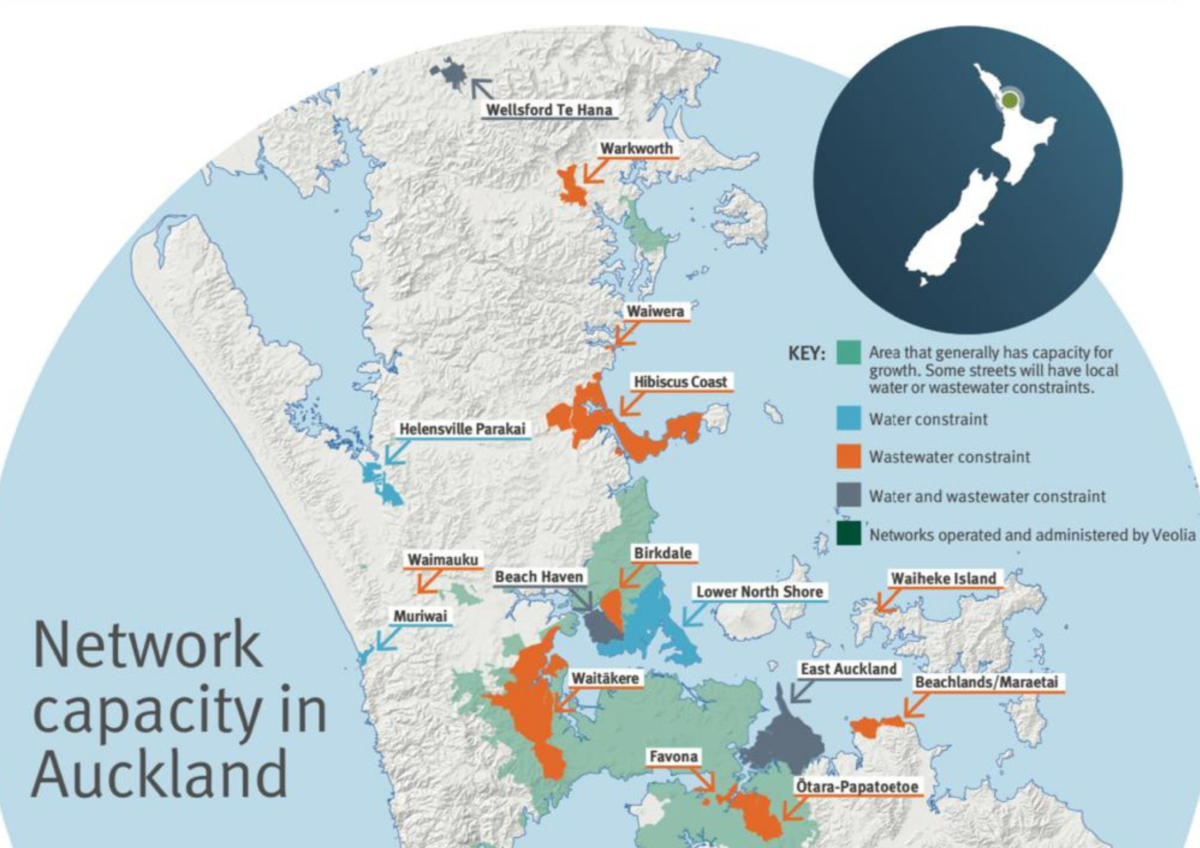

Recently parts of Auckland have been red-zoned by Watercare, Council Controlled Organisation CCO, effectively blindsiding many developers who have already bought land ready to develop.…

Subscribe and get news and information about our webpage